About the video - In the Video I have tried to give you all information about the Fixed Deposit (FD) Plan of Life Insurance Corporation of India (LIC) called. LIC Housing Finance Ltd. Offers fixed deposits accounts under the deposit scheme of Sanchay Public Deposit Form since May, 2007. The company has enjoyed a Crisil rating of AAA/Stable and CAREAAA for 12 years leading up to 2013. Documents Required for LIC Housing Finance Fixed Deposit The depositor will have to submit identity proof and address proof along with the duly-completed application form. The proof of identity can be passport, PAN card, driving license, Aadhaar card, etc., while proof of address can be latest electricity/gas bill, passport, Aadhaar, registered. LIC HFL FD calculator online - Calculate LIC HFL FD Interest rate using LIC HFL Fixed Deposit calculator 2021. Check LIC HFL FD rate of interest and calculate FD final amount via LIC HFL FD Calculator on The Economic Times. How Fixed Deposit Double Scheme differs from Normal Fixed Deposit. Both the normal fixed deposit and double scheme fixed deposits are essentially from the same family. Individuals having normal fixed deposits can choose the tenure for such deposits, which generally range from a few days to a few years.

LIC Housing Finance Fixed Deposit

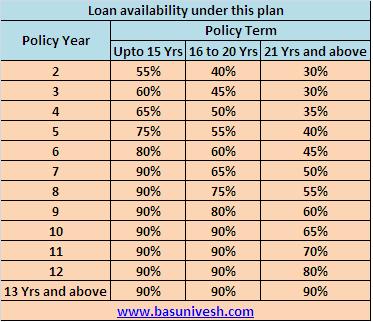

LIC Housing Finance FD is the new generation investment scheme offered by the Life Insurance Corporation of India (LIC) from the name of ‘Sanchay’. Any Indian national, Non-resident Indian, corporations, Co-operatives, etc. can apply for the LIC Housing Finance Fixed Deposit scheme. The scheme also offers the facility of loan against FD and premature withdrawal. Moreover, the LIC HFL Sanchay FD scheme also hasa good interest rate. The other information like interest rate chart, applying procedure, etc. have been provided below.

LIC Housing Finance FD Rates 2020

Note: Figures mentioned in the above provide table are subject to change without prior information.

Documents Required for The LIC HFL Sanchay

Procedure To Apply For LIC Housing Finance Fixed Deposit

- First of all, download the application form.

- Now fill the application form carefully and please provide only true details and attach the copy of the documents stated above.

- After that visit to the nearby LIC Housing Finance office with the said documents.

- Meet the executive, he/she will help you in further process of the application.

- Finally provide all the additional documents and details asked by the executive.

- Finally, your applying procedure for the FD scheme, Sanchay, by LIC HFL will be completed.

Note: The scheme allows the jointly deposit. Maximum 03 individuals can perform a single deposit account under the Sanchay scheme.

Major Facilities

Sanchay, an LIC fixed deposit scheme offers two major facilities to it customers that are-

Lic Fixed Deposits

- Loan Against FD

- Premature Withdrawal

Loan against LIC Housing Fixed Deposit (FD)

- The holder can apply for the loan against their LIC fixed deposit, here we are providing the features and the essential for the LIC Housing FD Loan.

- The fixed deposit deposited at least for a period of 3 months, at the time of applying loan.

- The life insurance corporation will provide the loan only up to the 75% of the deposited amount

- Corporation will charge the interest for the loan and the interest will be 2% p.a. above the FD rate

- The holder has an option to repay the loan lump sum or it can also be adjusted on the maturity of deposit amount.

Premature Withdrawal of LIC Housing FD

- The individuals can withdraw FD before the maturity date, the essential features for the same are-

- Such withdraw can only be after the completion of 03 months from the date of commencement of fixed deposit.

- The Rate of Interest will be-

Lic Fixed Deposit Plans

- बैंक सखी योजना क्या है | Bank Sakhi Scheme – योग्यता, ऑनलाइन फॉर्म की जानकारी - June 22, 2020

- Bad bank (बैड बैंक) क्या है | What is Bad Bank Explained in Hindi - June 22, 2020

- टर्म इन्शुरन्स क्या होता है | Term Life Insurance Explained in Hindi - June 22, 2020